Tax Shields and Net-of-tax returns on real and financial assets

Key concepts from last time

- Assets, investments, and projects all have different pre-tax returns ($r$).

- Tax rates ($t$) vary across individuals, jurisdictions, organizations, and assets.

Examples of 2.

- HK individual income tax ranges from 2% to 17%

- HK corporate tax is 16.5%

- US individual income tax ranges from 10% to 35%

- Mortgage interest is not taxed.

- US corporate tax rate was 35% until 2017, now 21%

- Investments (depreciation) are tax deductible

- Interest payments are tax deductible

- Note: non-Hong Kong tax laws are important for Hong Kong accountants, because these laws are often the reason why your clients/employers are doing business in Hong Kong.

Key concepts from last time

- Assets, investments, and projects all have different pre-tax returns ( $r$ ).

- Tax rates ( $t$ ) vary across individuals, jurisdictions, organizations, and assets.

- pre-tax returns of $r$ correspond to post-tax returns of $r(1-t)$

- for simple assets like savings accounts, money market funds and mutual funds.

Notice some thing similar for more complex assets

| Instrument | <div style="width:400px">Annualized Return</div> | |

|---|---|---|

| I. | Money Market Fund | $r(1-t)$ |

| II. | SPDA | $[(1+r)^{n}(1-t)+t]^{1/n} -1$ |

| III. | Mutual Fund | $r(1 - g)$ |

| IV. | Foreign Corporation | $[(1+r)^{n}(1-g)+g]^{1/n} -1$ |

| V. | Insurance Policy | $r$ |

| VI. | Pension | $r$ |

- Note: SPDAs and “Foreign” Corporations differ because taxes are paid on the income when you end the position.

- Note: That these are ‘annualized’ rates meaning the rate of return for each year.

- $r$ is the interest rate, $t$ is the income tax rate, and $g$ is the capital gains rate.

Key concepts from last time

- Assets, investments, and projects all have different pre-tax returns ($r$).

- Tax rates $t$ vary across individuals, jurisdictions, organizations, and assets.

- pre-tax returns $r$ correspond to post tax returns $r(1-t)$

- When preferential tax treatment increases demand for a tax favored asset it’s price increases. This price change is an implicit tax.

- When tax payers use organizational forms like pensions and insurance policies to avoid taxes it is called organizational form arbitrage.

- When high-tax tax payers issue taxable debt to finance the purchase of tax free debt (e.g. municipal bonds in the US) issued by low-tax tax payers (e.g. US non-profit universities) it is called clientele arbitrage.

Let’s look at the case (only 4:30 section)

- We are using an SPDA to illustrate a context in which a normal investor could implement a strategy like this.

- No need to memorize the SPDA formula.

- When comparing two options, always think about the revenue and costs that are unique to each scenario.

Now back to net-of-tax returns

Suppose there is a riskless financial asset that costs one dollar at the beginning of the period and pays $1 + r$ dollars at the end of every period. The difference, $r$, is taxed at rate $t$.

Thus, it is possible to borrow and lend at the after-tax rate of $r(1 - t)$ per period.

There is also a real asset costing $x > 0$. The asset produces a riskless pretax cash flow of $k$ in perpetuity at the end of each period.

Tax Treatment of Depreciation:

For tax purposes, the original cost of the asset may be depreciated straight line at rate $0 \leq d \leq 1$. Taxable income for any period is the pre-tax cash flow less the depreciation.

But wait!?!? Didn’t you just tell us not to consider depreciation?

- Why are we including depreciation?

- Notice where we include depreciation in the next equation!

Tax is paid at rate $t$, so that at the end of the first period, the net-of-tax cash flow is

\[k-t(k-dx)\]- $k$ is the return on the investment, $d$ is the depreciation rate, and $x$ is the investment.

Depreciation is impacting cash flow through it’s impact on the taxes you pay!

Tax Treatment of Depreciation:

We can rewrite the net-of-tax cash flow equation above as follows:

\[k(1-t) + dtx\]Now lets write down the cash flows from this project, and discount them.

What are the cash flows?

The cash outflow $x$ to acquire the asset is not tax deductible, so the first cash flow is just:

\[-x\]What are the cash flows?

- The second set of cash flows are the net-of-tax cash flows over the depreciable life of the asset discounted back to time zero at the after-tax rate of return

- $1/d$ is the number of periods you depreciate. e.g. if $d=.25$ then $1/d=4$ years

- the numerators are discounting cash flows relative with $r$ adjusted for $t$ you might recognize the formula from the previous lecture’s handout!

What are the cash flows?

The final set of cash flows we need to consider are then net-of-tax cash flows from the asset after the asset is fully depreciated.

\[\sum^{\infty}_{n=1+1/d}\frac{k(1-t)}{[1+r(1-t)]^{n}}\]- $1/d$ is the number of periods you depreciate. e.g. if $d=.25$ then $1/d=4$ years

- the numerators are discounting cash flows relative with $r$ adjusted for $t$ you might recognize the formula from the previous lecture’s handout!

So the total net-of-tax present value of these cash flows at the end of the first period is: \(-x + \sum^{1/d}_{n=1}\frac{k(1-t)+dtx}{[1+r(1-t)]^{n}}+\sum^{\infty}_{n=1+1/d}\frac{k(1-t)}{[1+r(1-t)]^{n}}\)

- $1/d$ is the number of periods you depreciate. e.g. if $d=.25$ then $1/d=4$ years

- the numerators are discounting cash flows relative with $r$ adjusted for $t$ you might recognize the formula from the previous lecture’s handout!

This quantity can be rewritten as follows:

\[-x+\frac{k}{r}+\frac{dtx}{r(1-t)}\Big(1-[1+r(1-t)]^{-1/d}\Big)\]This is using the annuity and perpetuity formulas.

Each of these terms has an important meaning:

\[-x+\frac{k}{r}+\frac{dtx}{r(1-t)}\Big(1-[1+r(1-t)]^{-1/d}\Big)\]The first term is the cost of the asset again.

Each of these terms has an important meaning:

\[-x+\frac{k}{r}+\frac{dtx}{r(1-t)}\Big(1-[1+r(1-t)]^{-1/d}\Big)\]The second term is the present value of the perpetual pre-tax cash flow from the asset, $k$, capitalized at the pre-tax rate, $r$. Note that this is the same as the after tax cash flow, $k(1-t)$, capitalized at the after tax discount rate, $r(1-t)$.

Each of these terms has an important meaning:

\[-x+\frac{k}{r}+\frac{dtx}{r(1-t)}\Big(1-[1+r(1-t)]^{-1/d}\Big)\]- The final term is the present value of the reduction in tax payments afforded by the depreciation deduction (often called the tax shield).

- Notice that this term has the same form as the present value of an annuity of $dtx$ for $1/d$ periods discounted at rate $r(1-t)$.

-

This is the only term where tax factors $d$ and $t$ play a role.

- If either the depreciation rate or the tax rate is zero, then the before tax and net-of-tax present values are the same.

-

If $d$ and $t$ are both positive then the value of the tax shield provided by depreciation is also positive. The value of the shield increases with both $d$ and $t$.

- If either the depreciation rate or the tax rate is zero, then the before tax and net-of-tax present values are the same.

- If $d$ and $t$ are both positive then the value of the tax shield provided by depreciation is also positive. The value of the shield increases with both $d$ and $t$.

- When tax depreciation is immediate, i.e., $d=1$, then the tax shield is

- If either the depreciation rate or the tax rate is zero, then the before tax and net-of-tax present values are the same.

- If $d$ and $t$ are both positive then the value of the tax shield provided by depreciation is also positive. The value of the shield increases with both $d$ and $t$.

- When tax depreciation is immediate, i.e., $d=1$, then the tax shield is

- This value can be substantial. Consider an investment that may be deducted fully from taxes in the year it is made, such as advertising. For $t=30\%$ and $r=10\%$, the tax shield is 28\% of the cost of the asset!

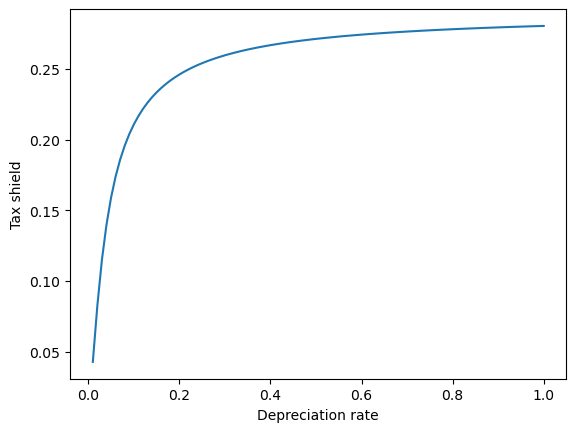

Let’s do some plotting to get a sense of this relationship

\[\frac{dtx}{r(1-t)}\Big(1-[1+r(1-t)]^{-1/d}\Big)=x\frac{t}{1+r(1-t)}\]First let’s plot the value of the tax shield as a function of the depreciation rate. Assume that $r=10\%$, and $t=30\%$

import matplotlib.pyplot as plt

import numpy as np

def tax_shield(d,t,r,x=1):

first_term = (d*x*t)/(r*(1-t))

second_term = 1-(1+r*(1-t))**(-1/d)

return first_term*second_term

First let’s plot the value of the tax shield as a function of the depreciation rate. Assume that $r=10\%$, and $t=30\%$

D = np.linspace(0.01,1,100)

plt.plot(D,tax_shield(D,t=0.3,r=0.1))

plt.xlabel('Depreciation rate')

plt.ylabel('Tax shield')

plt.show()

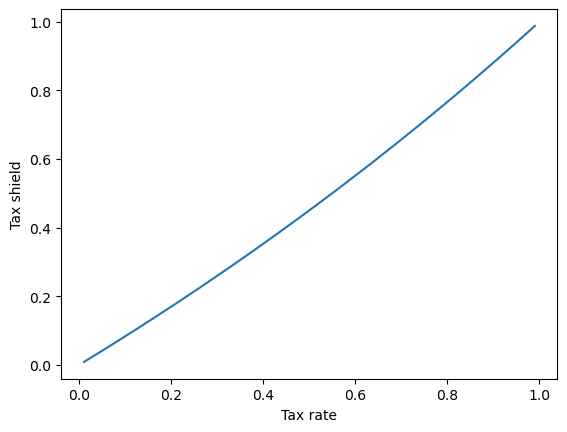

First let’s plot the value of the tax shield as a function of the depreciation rate. Now let’s plot the value of the tax shield as a function of the tax rate. Assume that $r=10\%$, and $d=30\%$

import warnings

warnings.filterwarnings('ignore')

T = np.linspace(0.01,1,100)

plt.plot(T,tax_shield(d=0.3,t=T,r=0.1))

plt.xlabel('Tax rate')

plt.ylabel('Tax shield')

plt.show()

One surprising conclusion that might be drawn from this analysis is that the net-of-tax present value of an investment is increasing in t.

That is, the higher the tax rate, the more attractive is the investment!

This might be the point!

- The depreciation tax shield makes investment more attractive.

- Investment encourages economic growth.

Questions:

- The statement above is a striking one. What must be held constant (and probably is not in real life) for it to be true?

- What condition defines equilibrium prices and returns on financial assets relative to real assets?

- What opportunities would you be able to exploit if you observed that prices and returns were not in equilibrium?

- What effect would your actions tend to have on prices and returns?

- Tricky question. What happens of the value of the depreciation tax shield as the tax rate, t approaches 100%? What is the intuition behind this result?

Questions:

- The statement above is a striking one. What must be held constant (and probably is not in real life) for it to be true?

- The demand for real assets! (implicit tax)

- Government spending may crowd out other types of investment.

- Also returns to scale.

- What condition defines equilibrium prices and returns on financial assets relative to real assets?

- No risk-free return from converting one to the other (no arbitrage)

- What opportunities would you be able to exploit if you observed that prices and returns were not in equilibrium?

- Arbitrage!

- What effect would your actions tend to have on prices and returns?

- Push them back to equilibrium.

Questions cont’d:

- Tricky question. What happens to the value of the value of the depreciation tax shield as the tax rate, t approaches 100%? What is the intuition behind this result?

- 100% of the value of the asset is as a tax shield.

tax_shield(d=0.3,t=.999999999,r=0.1)

1.0000001100223055

# TODO: add a slide for the value of a tax shield in hong kong